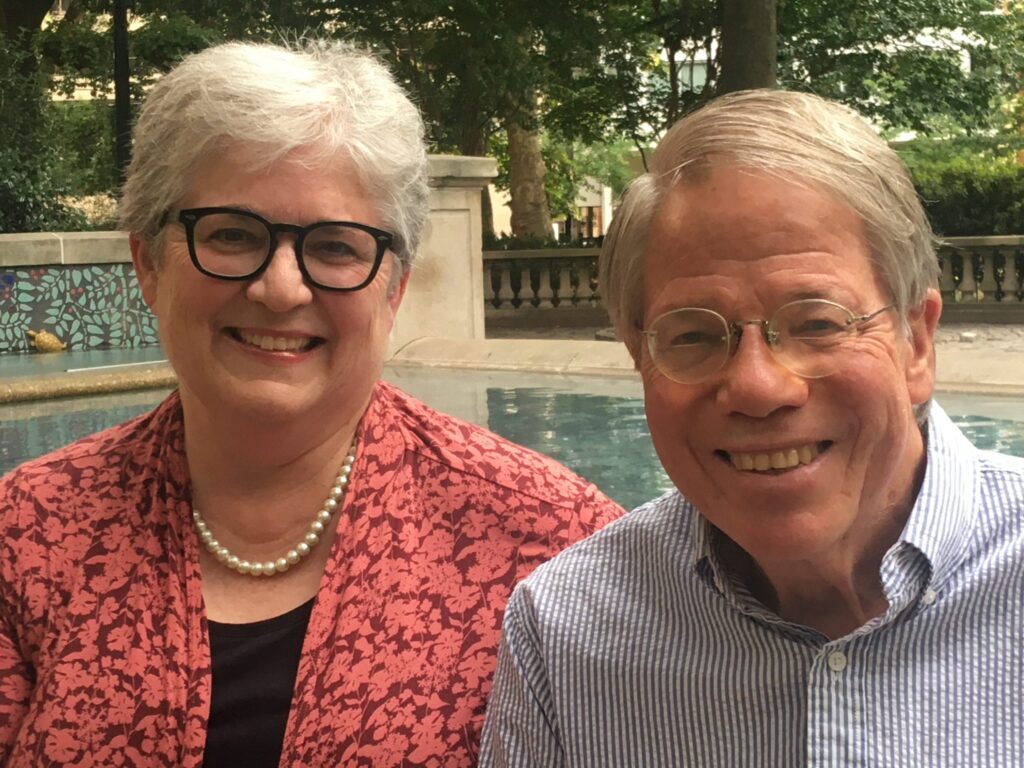

“Like most Philadelphians, we live among buildings that embody the varied stories of those who made them and have lived in them. Our lives are immensely enriched by this experience, and we’re putting the Preservation Alliance in our estate plan to help ensure that future generations will have the same opportunities.”

–Ann and David Brownlee

Five Square Society Membership

Make a significant and lasting contribution to our shared cultural heritage.

Five Square Society members substantially support our efforts to protect, preserve, and revitalize the architectural and cultural resources of the Greater Philadelphia Region’s historic places for generations to come.

Protect the future of the Greater Philadelphia region’s historic buildings, communities, and landscapes by including the Preservation Alliance for Greater Philadelphia in your estate plan or will.

Choosing the right planned gift depends on your personal circumstances and financial goals. You have several options to support the Preservation Alliance with a legacy gift:

- Include the Preservation Alliance in your will or living trust with a dollar amount or percentage of your estate.

- Designate the Preservation Alliance as a beneficiary of your retirement plan or life insurance policy.

- Leave the Preservation Alliance a gift of personal property such as stocks, bonds, mutual funds, or real estate.

- If you are 70 ½ or older, another way to support the Preservation Alliance is by making a Qualified Charitable Distribution from your IRA. You can contribute up to $100,000 from your IRA directly to a charity and avoid paying income taxes on the distribution. If this scenario applies to you, please consider the Preservation Alliance in your distribution plans.

Five Square Society Membership Benefits

Your membership in the Five Square Society requires no dues or solicitations, but it does allow us to thank and recognize you for the plans you have made. It may also inspire others to follow your lead. If you prefer to remain anonymous, your gift will be kept completely confidential.

Five Square Society members receive:

- An invitation to an annual special event with the Preservation Alliance Executive Director and Board President

- A Five Square Society membership certificate

- Acknowledgment on our website (optional)

- A complimentary subscription to Extant Magazine (if you don’t already receive it)

How to Join the Five Square Society

To get started and/or learn more, please email Susan Matyas at susan@preservationalliance.com. We would be happy to speak with you about the program. If you have already included the Preservation Alliance for Greater Philadelphia in your estate plans, please let us know so that we may thank you.

Tribute or Memorial Gifts

A tribute or memorial gift is a meaningful way to honor someone special. Gifts can be made to the Preservation Alliance for Greater Philadelphia to honor friends and family members on special occasions such as birthdays, anniversaries, weddings, and retirements. Remember a loved one with a memorial gift to the Preservation Alliance.

Your gift will be acknowledged to the person or family that you designate at the time of your gift. They will receive a card with the name of the person who is honored or memorialized, identifying you as the donor. The amount of the donation is not revealed to the honoree or the family. You will receive an acknowledgment for your tax-deductible contribution.

Complete and return this Tribute & Memorial Gifts Form to the Preservation Alliance. For more information, please contact Susan Matyas at susan@preservationalliance.com.

Qualified Charitable Distributions from an IRA

A Qualified Charitable Distribution (QCD) is a direct transfer of funds from your IRA, payable to a qualified charity. QCDs can be counted toward satisfying your required minimum distributions (RMDs) for the year, as long as certain rules are met.

In addition to the benefits of giving to charity, a QCD excludes the amount donated from taxable income, which is unlike regular withdrawals from an IRA.

Also, QCDs don’t require that you itemize, which due to the recent tax law changes, means you may decide to take advantage of the higher standard deduction, but still use a QCD for charitable giving.

Requirements

- You must be 70 ½ or older to be eligible to make a QCD.

- QCDs are limited to the amount that would otherwise be taxed as ordinary income. This excludes non-deductible contributions.

- The maximum annual amount that can qualify for a QCD is $100,000. This applies to the sum of QCDs made to one or more charities in a calendar year. (If, however, you are married and file taxes jointly, your spouse can also make a QCD from his or her own IRA within the same tax year for up to $100,000.)

- For a QCD to count towards your current year’s RMD, the funds must come out of your IRA by your RMD deadline, generally December 31.

If you would like more information on the numerous ways to make a gift, please contact Susan Matyas at susan@preservationalliance.com.

Your support helps save the Philadelphia Region’s historic buildings and preserve our neighborhoods.

The Preservation Alliance for Greater Philadelphia is officially licensed as a charitable nonprofit organization in the Commonwealth of Pennsylvania. A copy of the official registration and financial information may be obtained from the Pennsylvania Department of State by calling 1-800-732-0999. Registration does not imply endorsement.

All contributions are tax deductible to the fullest extent of the law.

EIN #23-2106589

Thank you for your support.